Rationale:

Hasaki Beauty & Clinic (established 2016, HCMC) is the most popular omni-channel cosmetics retailer in Vietnam that has more than 150 locations and good e-commerce coverage (~3.8M members, 750K shoppers monthly). Alibaba has minority investment (2023), which makes it more credible and scalable.

| Strategic Element | Description |

| Entry Mode | JV for product registration, marketing, and local fulfillment. |

| Operations | Import finished products from India; localize packaging and labeling. |

| Branding | “Sugandha x Hasaki – Naturally Beautiful from the Himalayas.” |

| Distribution | Hasaki physical stores + online store + Lazada/Shopee channels. |

| Pricing Strategy | Mid-premium segment; 10–15% below global luxury brands. |

| Target Audience | Women aged 20–40; urban centers (HCMC, Hanoi, Da Nang). |

Proposed Mod

Advantages:

- Regulatory compliance handled locally.

- Shared marketing costs and faster scaling.

- Builds trust via local partner’s reputation.

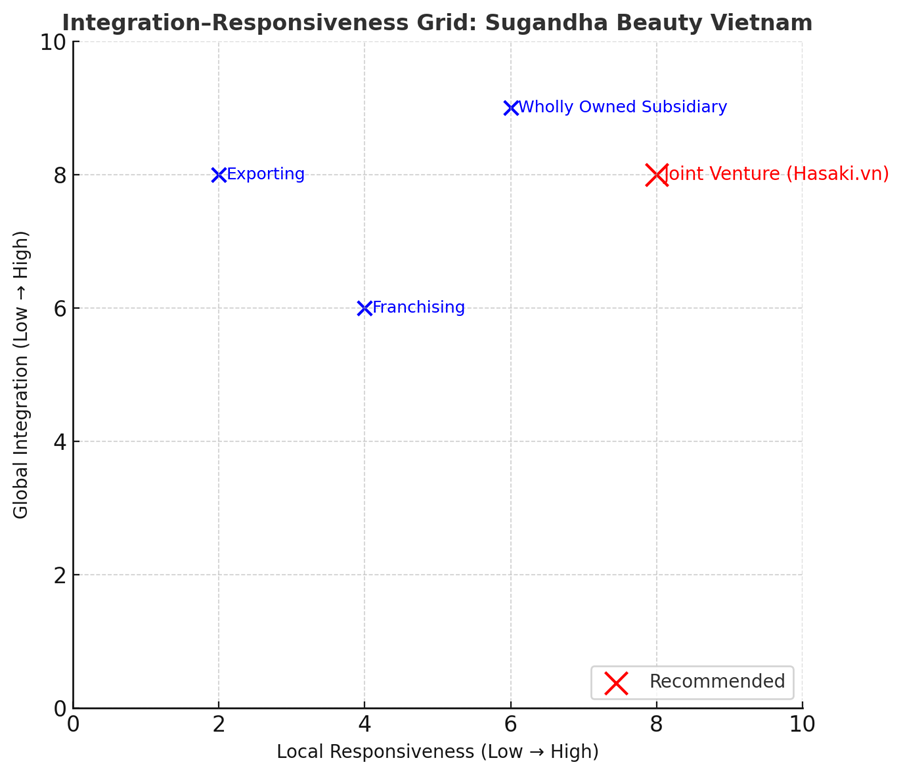

Sugandha Beauty Vietnam – Strategy Summary

🔹 Strategy Model:

Adopts a transnational strategy combining global integration with local adaptation.

🔹 Cultural Fit:

High local responsiveness via leadership, product, and service localization.

🔹 Global Alignment:

Maintains Sugandha’s Ayurvedic heritage, ethical sourcing, and sustainability standards across all touchpoints.

🔹 Strategic Grid Positioning:

Upper-right quadrant — High Global Integration & High Local Responsiveness.